The rise of fintech has brought about the monetary area rapidly acclimating to the changing scene that fintech developments have brought. This is clear with how the more seasoned, laid out associations are searching for fresher ways of doing their business so as not to get abandoned.

Research has it that fintech creates incomes adding up to billions of dollars each year and these figures are supposed to twofold in coming years. Monetary innovation has consolidated the most recent innovation developments with applications or monetary administrations. Consequently, it has incredibly assisted businesses with particularly beginning ups-to disturb the once ruled industry and subsequently offers better monetary types of assistance to people and organisations the same.

In this article, we will investigate monetary innovation.

What Is Fintech?

In the easiest of terms, fintech is utilised as a portrayal of monetary innovation, that is any industry that involves any type of innovation in monetary administrations going from shoppers to organisations.

“Fintech is a serious market where stirring things up around town is vital.”, as per AllFront. Fintech includes, or even better depicts any organisation that involves programming or other innovation in the arrangement of monetary administrations. Most of the items given by fintech are intended to be utilised easily by associating the purchaser’s funds with innovation. It has teamed up with various applications hence totally changing the entrance of funds by shoppers.

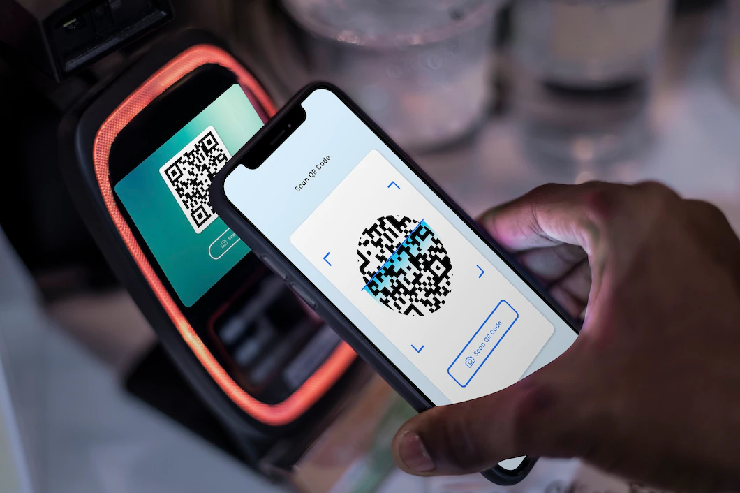

From protection and speculation organisations to versatile instalment applications like PayPal, fintech is a unique advantage that represents a gamble to monetary establishments like banks.

Monetary innovation involves a plenty of utilizations that are centred around the buyer, and the instruments given by this innovation are having an impact on the manner in which purchasers access, make due, track and work with their funds. Fintech focuses on contacting 2 billion individuals all around the world without ledgers and it gives a choice to this huge number of shoppers that they can get to monetary administrations even without the need of monetary establishments.

More or less, fintech has been created simply to utilise innovation to empower customers to get to their monetary lives.

Types Of Fintech Apps

Fintech applications are typically separated into 5 fundamental classifications:

– Personal Finance

– RegTech

– Digital Banking

– Investments

– Blockchain and crypto currency

1. Revolut (Digital Banking)

Revolut is a bright example of a capable and multi-functional digital banking that is gaining huge momentum. Launched back in 2015, the UK-based startup is now worth almost $2 billion and growing. How did they do it? In essence, Revolut provides its users with a refined fintech space for conducting major banking activities. This includes money transfer and storage, currency exchange, payments, and ATM withdrawal.

Operating within more than a hundred countries, the tool supports sending direct in-app transactions in 29 currencies, including popular cryptocurrencies like Bitcoin, Etherium, Litecoin, etc. In fact, the only thing you can’t do with Revolut is plain out print the cash.

2. Coinbase (Blockchain & Crypto)

Talking about alternative money, we can not skirt one of the most famous digital currency trades available at the present time – Coinbase. With a 25 million wide crowd, the stage empowers its clients to screen, put resources into, and exchange all the significant digital currencies in a protected and helpful way.

Among the primary accomplishments and elements, there are momentary cash moves inside the framework, a choice to plan customary everyday, week after week, and month to month acquisitions, and normally for its specialty – a first class degree of network safety to safeguard your assets. With everything taken into account, anybody in any way whatsoever connected with cryptographic forms of money probably found out about Coinbase, so it’s certainly among the top fintech applications to watch.

3. Nubank (Digital Banking)

This esteemed Brazilian startup is supporting quite possibly the most famous digital bank on the planet at the present time. Offering a large number of advantages as a Digital banking service, it permits to screen, make due, and pull out assets from any spot on the planet. The application can likewise flaunt a basic and natural point of interaction, alongside a broad prize framework to satisfy each client.

With all around accepted Mastercards, missing exchange expenses, and one of the most amazing UX/UI plans in the specialty, Nubank assumes today a very much procured position on our rundown.

4. Chime (Digital Banking)

One more brilliant illustration of a modern digital banking solution is Chime. What compels it to stand apart among its rivals is the virtual shortfall of charges, whether you’re moving the cash on the web or pulling out from its amazing organisation of a few ATMs.

Add a choice to consequently save 10% of gotten instalments and expenditures, alongside early support withdrawal – and you get every one of the motivations to put Chime on the rundown of the top fintech applications.

5. Robinhood (Investments)

With regards to present day fintech potential open doors, different speculation instruments possess an exceptional spot. In such a manner, Robinhood is a progressive web-based business arrangement. It empowers purchasing and overseeing basically every kind of speculation, from public organisations’ stocks to ETFs and files, to digital currencies – all at zero commission. The stage is coordinated with more than 3500 banks and gives continuous market information examination for the clients’ advantage and comfort.

All of the above has made it a main digital investment tool available, worth all of consideration.

6. MoneyLion (Digital Banking)

MoneyLion is one more splendid illustration of a modern digital banking solution. Ther tool gives a blend of loaning, reserve funds, and abundance to the board administrations on a membership premise. A portion of the help’s particular highlights incorporate a cross section of over 50.000 charge free ATMs, moment cash moves, and great cashback rewards.

MoneLion empowers its clients to loan, make due, and set aside cash in one spot, which was sufficient to make it a Unicorn startup this year and put it on our rundown of the top fintech applications to observe.

7. Tellus (Personal Finance, Real Estate)

Tellus is an enchanted wand for property and the board. Giving an overall stage to property managers and occupants to find, associate, and manage each other in a protected and helpful manner. The help gives in-application cash moves, informing, as well as following and the executives of all lease related exercises like screening, instalments, administrations, fixes, and so on. The assistance likewise offers no-charge, no-restriction stores with moderate interest for “brilliant” reserve funds.

With everything that is expressed, Tellus is certainly one more device to put on our rundown today.

Benefits Of FinTech Or Financial Technology

Financial technology has carried a humongous different method for working money organisations. This doesn’t imply that traditional banking has evaporated. It simply implies that fintech has clients a choice to browse whenever the timing is ideal.

Both-conventional banking and technology led financial services are settled on conveying excellent client experience with their monetary administrations or monetary items.

I) Greater Convenience

As we began, the Financial area is more about offering accommodation than about burning through cash. Fintech programming in organisations offers the most helpful approach to working a financial business.

Organisations are taking on Fintech on the grounds that it utilises innovations to give clients a superior and more dependable client experience. The innovation that is upgrading the monetary organisations is Blockchain, man-made consciousness, IoT, AI, and a few other monetary innovations that will help them in the more extended run.

Fintech has smoothed out the greater part of the money cycles and organisations by offering accommodation readily available. We have seen the financial business and insurance agency blossoming in questionable times by offering progress and state of the art new advances.

II) Robo Advisors

Robo advising is exceptionally new and one regarding the main areas of fintech. Organisations offering these types of assistance pose buyers explicit inquiries and foster a modified venture system utilising particular calculations. Commonly, when you begin doing a venture, there is no base store to begin a record, and consultants can pick minimal expense resources. Later relying upon the resources, you brought or needed to keep, to make to pay for the administrations.

There are no additional charges for resource portions or adjusting. Additionally, it is one of the least difficult approaches to arranging a speculation or future financial arrangement. On the off chance that you are pondering where these Robo counsellors are, you can think that they are on the web.

There are an assortment of Robo counsellors to choose from and there are some who require a bigger starting responsibility than others. Many will allow you to make a record with a lesser store and will deal with the rest for you. It doesn’t require a great deal of exertion from you.

There is an arrangement made for you that relies upon your favoured schedule and hazard resistance. A calculation can be utilised to oversee and design.

III) Customer Services And Revenue

Fintech works on the nature of conventional monetary foundations by expanding effectiveness and efficiency. As banks and credit associations see fintech organisations as companions on this street as opposed to sellers, more open doors emerge.

Besides, by conveying better and more contemporary administrations, firms’ client degrees of consistency are sure to rise, bringing about expanded incomes.

IV) Speed

At the point when you apply for a loan application online, it should be approved by digital only lenders that can give same-day financing, which is just achievable as a result of Fintech development.

On the off chance that you want a momentary credit or a payday credit, with fintech it gets more straightforward. You can just find numerous moneylenders on the web and gain admittance to speed assist.

Fintech is a savvy, proficient, helpfuance. Customary Banks might not enjoy a similar benefit and it would require a very long time for them to make it happen rapidly.

V) Efficiency

This is an inferred advantage of fintech innovation that it can offer effectiveness with any remaining clear advantages. Fintech is known for adding effectiveness to the interaction.

At the point when you utilise monetary innovation, you are as of now proficient on the grounds that it offers incredibly specific types of assistance.

Robotization doesn’t include people and consequently computerization offers an elevated degree of specialisation. Subsequently, it has a serious level of effectiveness and administration quality.

We as a fintech organisation can be fast and nimble both simultaneously. Fintech permits you to put resources into answers for various reasons, yet the outcomes are explicit improvement in proficiency and using time productively.

VI) Reduced Costs

At the point when you utilise new-edge innovations or technologies, you could feel that it might cost you a fortune however not really this is valid. The fintech organisations limit themselves from spending huge sums on innovation.

In any case, that isn’t accurate with monetary innovation, they would really be adding to decreasing by and large expenses. The blend of physical and computerised instalments has been brought into a merged stage utilising Fintech by incorporating the financial balance cards and client ids.

The significant viewpoint that works for organisations is the manner in which they offer helpful exchange choices on a confined spending plan.

As a matter of fact, these advances permit organisations to send and get cash from their records in various monetary standards without charging any causing high change expenses. Convenience is the force of monetary innovation and not cost.

You can also read “Eight Innovative Ways Fintech Is Changing The Way You Use Money“.

In A Nutshell

The fintech business is up and powered by the pandemic-related contact limitations, alongside more extensive blockchain reception and generally digitization of our regular routines, the interest for cutting edge IT arrangements in the money area right currently is concealed previously.

This is an extraordinary time for the purchasers to investigate and appreciate new fintech devices and arrangements, and a significantly more noteworthy second for business people to get on board with that temporary fad and construct an effective fintech business in the specialty. What’s more, the applications referenced above give an extraordinary guide to make the statement.