As we all know, companies are putting their best to come up with environment-friendly solutions in all sectors. Virtual credit cards are the result of this struggle only. It is the new generation payment option that is only available online, as its name suggests. So, what is exactly the virtual credit card solution?

A virtual credit card is an online card with randomly generated 16 numbers, expiry date, card verification number (CVV). It works similarly to physical or traditional credit cards. The major difference is its availability as, we already stated, these cards are available virtually. American Express, Mastercard, and VISA are the leading companies that are dealing with virtual credit cards. This card is getting famous among businesses more than common people. Businesses say this card is a lot more beneficial and convenient than traditional credit cards.

Do You Know?

Virtual credit cards are not today’s innovation, its existence has been there since 2010 in Europe. Almost 85 million users had an active virtual credit card till 2017. Most of the businesses that deal internationally feel that virtual credit cards are way more opportune than physical cards as they allow you to make international transactions without visiting the bank.

Since the key difference is its virtual presence, why do people still get attracted to virtual credit cards? There must be a few additional advantages of having it, let’s discuss the same.

Benefits Of Virtual Credit Cards

1. Secured Payment Solution

Physical credit cards are more prone to payment fraud as they could be stolen anytime. It is hard to detect whether the person has a card or not. Virtual credit cards can not be targeted for stealing, especially by a random person.

Moreover, you can set your spending limit on your own which can be changed anytime in the future with no effort at all. Like disposable utensils, you can dispose off these cards after one-time use too. Some banks give an option to re-issue another virtual credit card after each payment due to security reasons. That means, if you are using virtual credit cards, your accounts are safe and there is no chance of payment fraud.

2. Easy Banking

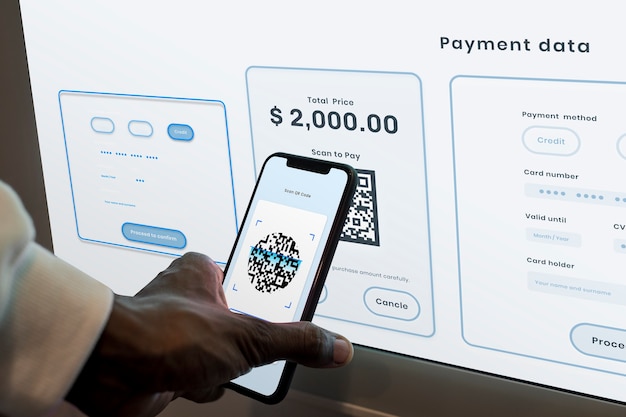

As we already stated above, virtual credit cards are really useful. for international businesses. Virtual banks are open 24*7 to serve you anytime, anywhere. You do not need to wait for 7-14 days to open a bank account as everything is running online so, it doesn’t take much time. You can expect your bank account to start within a few hours. All you need is a phone from which you will be able to perform all bank related activities.

So forget all the manual mistakes and the paperwork that frustrates and resists us to explore more banking solutions as everything is just one tap away.

3. Secure Online Shopping

As it is a virtual credit card, you do not need to sit with your credit card to make a transaction. It can be done easily with the banking app. Moreover, you do not need to save your banking or card details on any e-commerce website that makes your shopping experience more secure and easy.

Also, to promote virtual credit cards, e-commerce websites give additional discounts or offers that can be availed of.

4. Cost-Effective

Many banks offer virtual credit cards free to their customers to promote their existence and aware of its benefits. Whereas banks charge a good amount as a card fee from the individual, or if it’s for businesses then the prices are way more than the individual cards. Moreover, various companies and brands give promotional offers on virtual cards.

With each penny spent, you can earn a cashback or redeemable points at every partner store or website. Moreover, everything is online its the operational cost to the bank is quite less than physical cards.

5. No Mystery Payments

Even if someone else is using your card, you can still track the flow through the bank’s card management system. You will get all the information relating to transactions there. Be it the place, time and amount, everything will be tediously available with labels to make it easy for tracking.

Through this, you will not need to check the bills and purchase invoices every time to check where the money has gone or is there any mystery payment hidden? Hence, one can expect transparency with virtual credit cards.

Conclusion

You must think of having one for yourself or your business. It doesn’t involve any cost and comes with low-processing formalities. One can expect to have multiple benefits with virtual credit cards such as payment security, transparency of all transactions that decrease the chances of mystery payments, card stealing becomes next to impossible as there is no physical presence of the card is available and you do not need to save card details on any website or payment platform as you can have your virtual card handy every time in your phone. Additionally, if in case your phone gets robbed or data gets stolen, you can immediately block all the banking services for a specific period of time as everything is online. Now you have to decide, whether you need an eco-friendly and much more secure option for your baking needs or not.